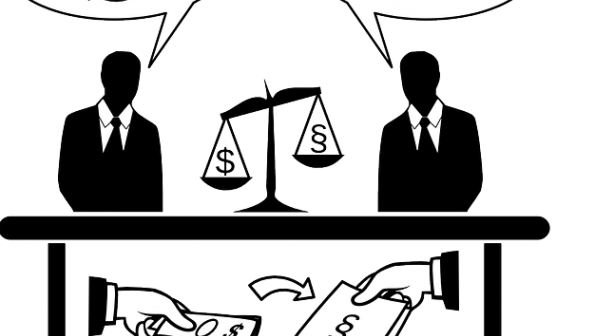

This paper investigates the effect of the share allocation process on the efficiency of a regulated entity operating under imperfect information. A forward looking government privatizes a firm to foster its political agenda. The government pins down the initial ownership structure, i.e. dispersed or concentrated ownership, by choosing the allocation of shares among retail and institutional investors. In addition, it lays out the regulatory policy that will govern the firm following privatization. Under concentrated ownership, institutional investors decide to lobby the government for a favorable regulatory policy in exchange for a monetary transfer. We show that the initial ownership structure plays a key role in post privatization efficiency through its interaction with the endogeneous regulatory policy. We characterize the conditions under which high ownership concentration leads to overinvestment with an associated loss of consumer welfare. We show that the generation of this inefficiency is robust to the specification of the information asymmetry as an adverse selection or moral hazard problem.